AI’s expansion into the physical world is reshaping what investors choose to back

Updated

February 12, 2026 1:21 PM

Exterior view of the Exchange Square in Central, Hong Kong. PHOTO: UNSPLASH

Artificial intelligence is often discussed in terms of large models trained in distant data centres. Less visible, but increasingly consequential, is the layer of computing that enables machines to interpret and respond to the physical world in real-time. As AI systems move from abstract software into vehicles, cameras and factory equipment, the chips that power on-device decision-making are becoming strategic assets in their own right.

It is within this shift that Axera, a Shanghai-based semiconductor company, began trading on the Hong Kong Stock Exchange on February 10 under the ticker symbol 00600.HK. The company priced its shares at HK$28.2, debuting with a market capitalization of approximately HK$16.6 billion. Its listing marks the first time a Chinese company focused primarily on AI perception and edge inference chips has gone public in the city — a milestone that underscores growing investor interest in the hardware layer of artificial intelligence.

The listing comes at a time when demand for flexible, on-device intelligence is expanding. As manufacturers, automakers and infrastructure operators integrate AI into physical systems, the need for specialized processors capable of handling visual and sensor data efficiently has grown. At the same time, China’s domestic semiconductor industry has faced increasing pressure to build local capabilities across the chip value chain. Companies such as Axera sit at the intersection of these dynamics, serving both commercial markets and broader industrial policy priorities.

For Hong Kong, the debut adds to a cohort of technology companies seeking public capital to scale hardware-intensive businesses. Unlike software firms, semiconductor designers operate in a capital-intensive environment shaped by supply chains, fabrication partnerships and rapid product cycles. Their presence on the exchange reflects a maturing investor appetite for AI infrastructure, not just consumer-facing applications.

Axera’s early backer, Qiming Venture Partners, led the company’s pre-A financing round in 2020 and continued to participate in subsequent rounds. Prior to the IPO, it held more than 6 percent of the company, making it the second-largest institutional investor. The public offering provides liquidity for early investors and new funding for a company operating in a highly competitive and technologically demanding sector.

Axera’s market debut does not resolve the competitive challenges of the semiconductor industry, where innovation cycles are short and global competition is intense. But it does signal that investors are placing tangible value on the hardware, enabling AI’s expansion beyond the cloud. In that sense, the listing represents more than a corporate milestone; it reflects a broader transition in how artificial intelligence is built, deployed and financed — moving steadily from software abstraction toward the silicon that makes real-world autonomy possible.

Keep Reading

How a Korean biotech startup is using AI to move drug discovery from trial-and-error to precision design

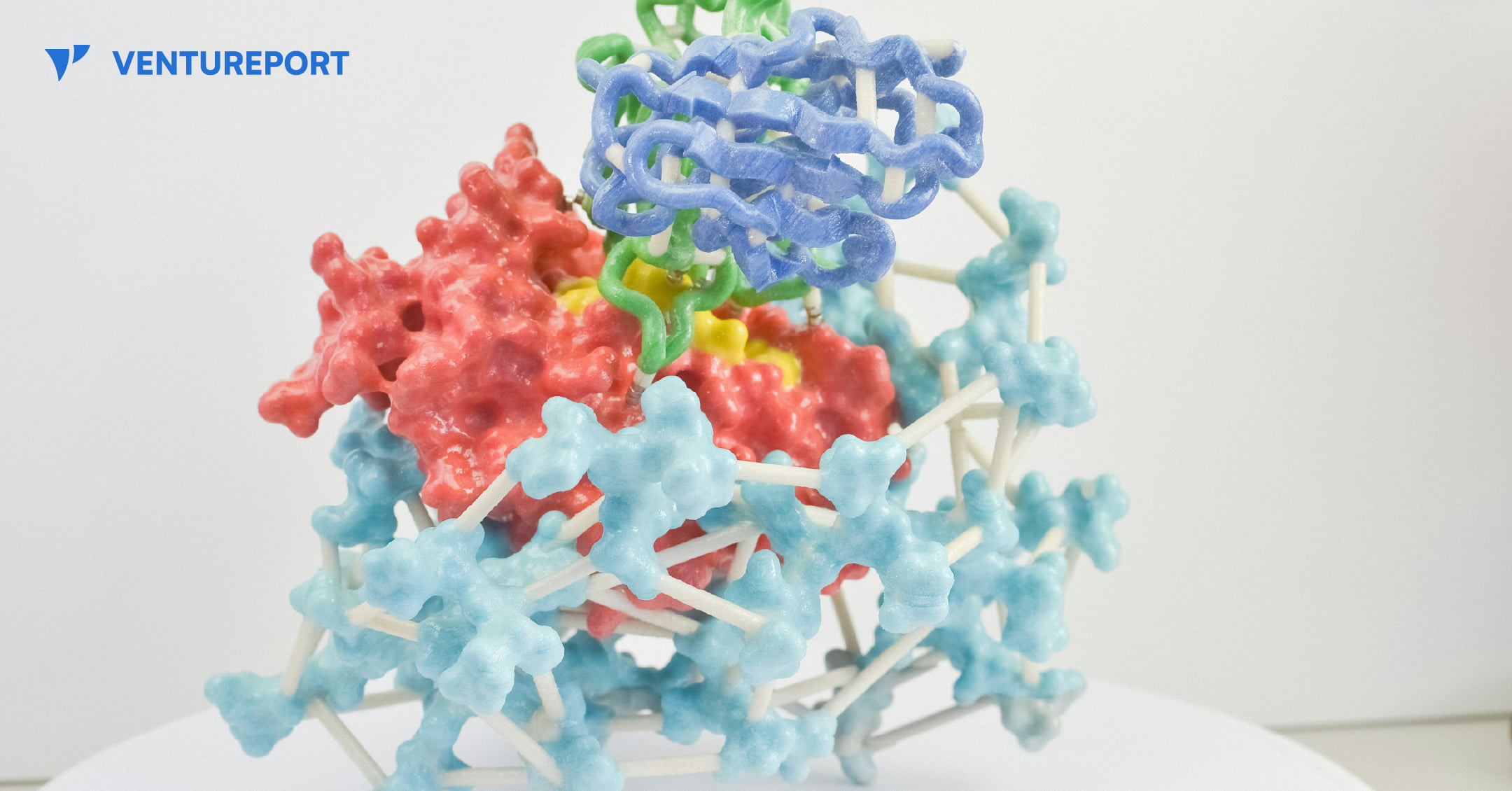

A close up of a protein structure model. PHOTO: UNSPLASH

For decades, drug discovery has relied on trial and error, with scientists testing thousands of molecules to find one that works. Galux, a South Korean biotech startup, is changing that by using AI to design proteins from scratch. This method, called “de novo” design, makes it possible to build precise new therapies instead of searching through existing ones.

The company recently announced a US$29 million Series B funding round, bringing its total capital to US$47 million.This significant investment attracted a substantial roster of institutional backers, including the Korea Development Bank (KDB), Yuanta Investment, SL Investment and NCORE Ventures. These firms joined existing investors such as InterVest, DAYLI Partners and PATHWAY Investment, as well as new participants including SneakPeek Investments, Korea Investment & Securities and Mirae Asset Securities.

At the core of the company’s work is a platform called GaluxDesign. Unlike many AI tools that only predict how existing proteins fold, this system uses deep learning and physics to create entirely new therapeutic antibodies. This “from scratch” approach lets the team go after so-called “undruggable” proteins. These are targets that traditional small-molecule drugs can’t reach because they lack clear binding pockets. By designing proteins to fit these complex shapes, Galux aims to unlock treatments that have stayed out of reach for decades. And that’s exactly why investors are paying attention.

The pharmaceutical industry is actively looking for faster and more efficient ways to develop new drugs, and Galux is built for exactly that. The company connects its AI platform directly to its own wet lab, where designs can be tested in real time. Each result feeds straight back into the system, sharpening the next round of models. This continuous loop speeds up discovery and improves precision at every step. It’s also why partners like Celltrion, LG Chem and Boehringer Ingelheim are already working with Galux.

Galux is no longer just trying to make drugs that stick to a target. The company now wants its AI to design medicines that actually work in the body and can be made at scale. In simple terms, a drug has to do more than bind to a disease—it must be stable, safe and strong enough to change how the illness behaves. Galux is moving into tougher targets such as ion channels and GPCRs. These play key roles in heart function and sensory signals. Ultimately, the goal is to show that AI-driven design can turn complex biology into real treatments. And instead of hunting blindly for a solution, the team is building exactly what they need.